Google Pay (GPay) has evolved far beyond UPI payments and bill recharges. In 2026, it has become one of India’s most trusted digital loan marketplaces, offering instant personal loans in partnership with RBI-registered banks and NBFCs.

Whether you need an emergency personal loan, a small sachet loan, or a high-value loan up to ₹10 lakh, Google Pay provides a fast, paperless, and secure borrowing experience.

Google Pay Personal Loan 2026: Complete Overview

Google Pay does not lend money directly. Instead, it acts as a bridge between users and verified financial institutions, ensuring competitive interest rates and quick approvals.

Key Loan Features (2026 Estimates)

| Feature | Details |

|---|---|

| Loan Amount | ₹10,000 to ₹10,00,000 |

| Interest Rate | 9.99% – 24% p.a. (Reducing Balance) |

| Repayment Tenure | 6 months to 60 months |

| Processing Fee | 1% – 4% (varies by lender) |

| Approval Time | Instant to a few minutes |

| Disbursal Time | Same day (often within minutes) |

Top Google Pay Lending Partners in 2026

In 2026, Google Pay features a curated list of trusted banks and NBFCs, allowing users to choose the best offer based on their credit profile.

Popular Lending Partners on GPay

- DMI Finance – Ideal for instant sachet loans and users with limited credit history

- Axis Bank – Best for high-value personal loans with competitive interest rates

- Aditya Birla Finance – Suitable for large loan amounts and flexible repayment options

- Moneyview & CASHe – Digital-first lenders focusing on young professionals and gig workers

Eligibility Criteria for Google Pay Loans (2026)

To apply for a personal loan on Google Pay, you generally need to meet the following conditions:

- Age: 21 to 55 years

- Income: Minimum ₹15,000 monthly salary (bank account credit required)

- Credit Score:

- 700+ preferred

- 650+ may be considered by lenders like DMI Finance for existing users

- KYC Documents:

- Aadhaar Card

- PAN Card (linked with mobile number)

How to Apply for a Google Pay Personal Loan (Step-by-Step Guide)

The entire loan process on Google Pay is 100% digital and paperless.

Step-by-Step Application Process

- Open Google Pay App

Go to the “Money” or “Manage your money” section - Check Loan Offers

Tap on “Loans” and look for Pre-approved or Get Started - Choose Loan Amount & Tenure

Use the slider to select the required amount and repayment period - Review Loan Details

Check EMI, interest rate, and total payable amount - Complete e-KYC

Verify your identity using Aadhaar OTP - Set Up Auto-Debit

Activate e-Mandate for EMI payments - Instant Disbursal

After e-signing the agreement, money is credited within minutes

Benefits of Taking a Loan via Google Pay in 2026

- Complete Transparency – Interest rates, processing fees, and APR are shown upfront

- Paperless Process – No branch visit or physical documents required

- Fast Approval & Disbursal – Ideal for emergencies

- Flexible Repayment Options – Many lenders offer zero foreclosure charges after 6 months

- High Security – Only RBI-registered NBFCs and banks are listed, reducing fake loan app risks

Is Google Pay Loan Safe in 2026?

Yes. Google Pay follows strict RBI guidelines and partners only with licensed lenders, ensuring data security, encrypted transactions, and user protection against fraud.

- GPSC Recruitment 2026: 279 Class-1 & Class-2 Vacancies Announced Across Gujarat Departments

- Railway Group D Recruitment 2026: 22,195 Vacancies Announced for 10th Pass & ITI Candidates

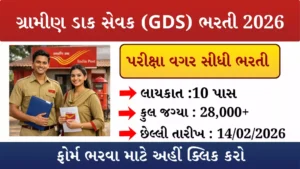

- India Post GDS Recruitment 2026 – Apply Online for 28000+ Posts

- Traffic Brigade Recruitment 2026: Apply for 08 Traffic Warden Posts in Gandhidham, Adipur & Anjar

- SBI CBO Recruitment 2026: Apply Online for 2050 Circle Based Officer Posts

- Central Bank of India SO Recruitment 2026: Apply Online for 350 Foreign Exchange & Marketing Officer Posts

Final Thoughts

If you’re looking for a quick, secure, and fully digital personal loan up to ₹10 lakh, Google Pay Loan in 2026 is one of the best options available in India. With instant approvals, flexible repayment, and trusted lending partners, GPay continues to redefine digital lending.