The Government of India has always focused on empowering farmers and supporting agriculture with financial schemes that facilitate growth and development. One such revolutionary initiative is the Kisan Credit Card (KCC) Yojana, designed to provide timely and affordable financial assistance to farmers, making agriculture more profitable and sustainable. The KCC has undergone significant revisions to provide enhanced benefits to farmers, and it continues to be a lifeline for millions of agricultural workers across the country.

What is Kisan Credit Card Yojana (KCC)?

Launched with the objective of offering affordable credit to farmers, the Kisan Credit Card Yojana helps farmers access financial support quickly for various farming needs. The scheme aims to reduce the burden of high-interest loans, allowing farmers to avail themselves of credit facilities at lower rates to meet their farming expenses.

Key Features of the Kisan Credit Card Scheme

| Feature | Details | Benefits to Farmers |

|---|---|---|

| Maximum Loan Limit | Up to ₹5 lakh | Helps farmers meet large farming expenses easily. |

| Interest Rate | 0% (on timely repayment) | Benefit of interest-free loans, reducing farming costs. |

| Primary Objective | Affordable credit for farming expenses (Crop Loan) | Quick financial aid for seeds, fertilizers, and pesticides. |

| Beneficiary | All farmers in India | Especially beneficial for small and marginal farmers. |

Note: The government provides an interest subsidy on loans up to ₹3 lakh. Loans up to ₹5 lakh are provided by banks based on the farmer’s eligibility and land holdings. 0% interest is available for those who make timely repayments.

Benefits of the Kisan Credit Card (KCC) Scheme

The Kisan Credit Card scheme offers multiple benefits to farmers, making farming a more viable and profitable venture:

- Farming Expenses: Farmers can use the loan for essential farming needs such as purchasing fertilizers, seeds, pesticides, and irrigation equipment.

- Fast Assistance: The application process is quick and straightforward, with minimal paperwork, ensuring that farmers receive financial aid without delay.

- Increased Income: By eliminating the interest burden on loans, farmers’ expenses are reduced, leading to higher profit margins.

- Simple Process: Unlike traditional loans, the KCC application process is simple and easy to understand, making it accessible to all farmers, even in rural areas.

How to Apply for Kisan Credit Card (KCC)?

The process of applying for a Kisan Credit Card has been simplified for the convenience of farmers. Farmers can apply for the KCC both offline and online.

Application Process

- Visit Your Bank: Farmers can visit any nationalized bank like State Bank of India (SBI), Punjab National Bank (PNB), or Bank of Baroda and fill out the application form for the KCC.

- Online Application: Several banks now provide the option of applying online through their official websites. This allows farmers to apply for the KCC from the comfort of their homes.

- Required Documents: The following documents are necessary for applying for a Kisan Credit Card:

- Aadhar card and PAN card

- Land document (such as Extract 7/12, 8-A)

- Bank passbook (Farmer’s account)

- Passport-sized photograph

- Proof of income (if requested by the bank)

Important links

| Info In Gujarati | View |

| Home page | Click here |

- GSSSB CCE Recruitment 2026: Notification Out for 5370 Posts, Apply Online

- Income Tax Gujarat Recruitment 2026: Apply Online for 46 Tax Assistant & MTS Posts

- GPSC Recruitment 2026: 279 Class-1 & Class-2 Vacancies Announced Across Gujarat Departments

- Railway Group D Recruitment 2026: 22,195 Vacancies Announced for 10th Pass & ITI Candidates

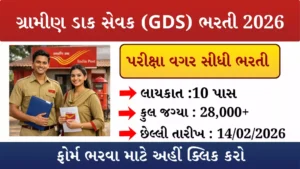

- India Post GDS Recruitment 2026 – Apply Online for 28000+ Posts

- Van Vibhag Bharti 2026 : Vanya Prani Mitra Apply for Forest Department Wildlife Friend Posts in Gujarat

Conclusion: A Revolutionary Step for Farmers

The Kisan Credit Card Yojana is a groundbreaking initiative aimed at transforming the lives of farmers by providing them with easy access to credit at affordable rates. The provision of loans up to ₹5 lakh with 0% interest offers a substantial relief, allowing farmers to focus on their crops without worrying about high-interest repayments.

By addressing the financial needs of farmers, the KCC scheme empowers them to manage their farming operations efficiently, purchase inputs like seeds and fertilizers, and improve their overall income. With the government’s continued support, this initiative promises a brighter future for farmers across India.